Login with email

Login

Login with your email or your MT4 credentials.

In CFD trading, there is a hidden cost that can quietly chip away at your profits: the spread. This is the primary cost of opening and closing a position, in other words, the price of admission to the market. Mastering the spread helps minimise costs and maximise efficiency, so it is essential for savvy traders to understand this transaction cost.

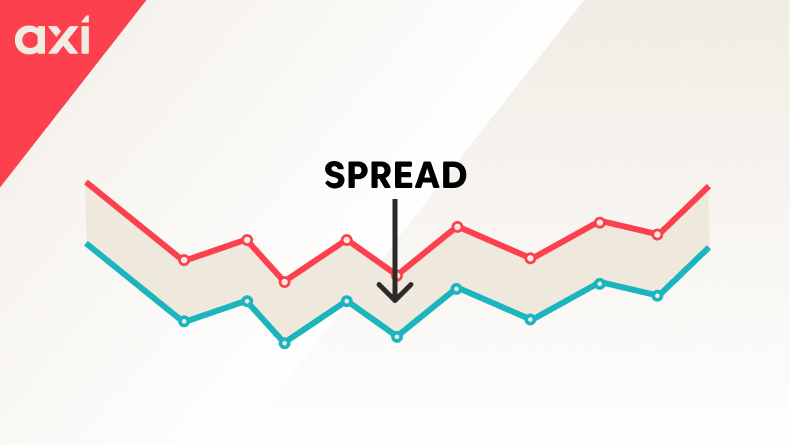

Financial instruments have two prices: the ‘bid’ and the ‘ask’ price. The bid is the slightly lower price they are willing to buy an asset from you, and the ask is the slightly higher price they are willing to sell it to you.

The spread is the difference between these two prices. This gap between buying and selling prices is an indicator of liquidity, risk appetite, and potential opportunities. A narrow spread often suggests a healthy liquid market and lower costs, while a wider spread signals lower market activity or higher volatility.

While the bid-ask gap exists in all markets, in the context of CFDs, the spread is the broker’s primary transaction cost for facilitating the trade. Instead of charging a separate commission, many CFD brokers simply embed their fee into this difference.

This is why most brokers use floating spreads, which constantly shift based on the day’s trading activity and volatility. Furthermore, spreads vary by asset class (forex, stocks, indices, commodities, crypto) due to differences in liquidity, volatility, and market conditions.

The spread is paid upfront when a CFD trade is opened. For a trade to break even, the market price must move beyond the cost of the spread.

Spreads are calculated as the difference between the bid and ask price.

Example from the stock market:

Microsoft Corp. (MSFT): Bid = $510.12, Ask = $510.18 → Spread = $0.06 (tight, liquid).

Mid-cap company: Bid = $65.00, Ask = $65.40 → Spread = $0.40 (wider, less liquid).

In forex, CFD spreads are often quoted in pips.

Example: GBP/USD moves from 1.2750 to 1.2751 → difference of 0.0001 = 1 pip.

On trading platforms like MT4, spreads are shown in points (1 pip = 10 points).

The impact of the spread is simple and crucial: it determines your transaction cost and how quickly a trade can recover that cost.

Narrower spreads reduce the financial friction of trading. This is particularly important for active traders, such as high-frequency traders and day traders, who open and close many positions daily. By minimising the upfront transaction cost on each trade, they can more efficiently manage their overall trading expenses.

Conversely, a wider spread requires the market price to move significantly further in your favour just to cover the initial transaction fee. This effectively creates a higher barrier to entry and recovery, making it more challenging to manage costs, especially during periods of volatility.

Your biggest ally in minimising spread costs is your broker's technology. It's not enough to look for the "lowest advertised spread". Instead, focus on the average spreads a broker can consistently deliver under normal market conditions.

Why average spreads matter: The best brokers don't rely on a single source of price data. They connect to multiple Liquidity Providers (LPs) and use smart aggregation technology to instantly scan for the best price. This enables them to select the highest bid from one LP and the lowest ask from another, resulting in a synthetic quote that ensures the smallest possible spread for their clients.

For instance, if LP A quotes 1.2000 / 1.2002 and LP B quotes 1.2001 / 1.2003, the broker’s aggregation would select 1.2001 (best bid) and 1.2002 (best ask), producing a synthetic spread of just 0.1 pip.

Example of Axi average spreads

Explore Axi average spreads to see the full list and compare performance across instruments.

Spread values are set as the average based on live data from the US trading session (13:00–21:00 GMT) on 30th September 2025. These spreads may vary based on market conditions.

Pro account is subject to a $4.5 round trip commission. To get a full overview of all available CFD instruments and their active time zones, refer to product schedule.

💡Fair and transparent pricing in important in trading, allowing traders to compare different brokers and trading conditions and avoid paying more than expected. Axi is fully committed to price transparency, offering marketing-leading spreads in the most liquid markets like Gold (XAUUSD), EURUSD, GBPUSD, Crude Oil, and Bitcoin.

Focus on currency pairs that typically have tighter spreads, as these can reduce transaction costs and improve efficiency.

Avoid high-spread times: low-liquidity hours (e.g., 4–9 PM EST) and major news releases. Wider spreads are common in less liquid markets or during volatile periods, making it harder to enter or exit positions without slippage.

Check live spreads on your platform rather than relying on chart visuals.

For experienced traders with larger accounts, accounts like Axi’s Pro account offer spreads starting from 0.0 pips and $4.5 round trip commission.

💡A note on charts and slippage: Always check the live spread on your trading platform, not just the chart visual. Charts typically display only the bid price, which can lead to confusion. This is often mistaken for slippage when your order doesn't fill at the exact price shown. It's not slippage; it’s a necessary cost of the spread, as your buy order is priced off the ask (the higher price) while your sell order is priced off the aid (the lower price).

Commission-free models have clear advantages. They are potentially more transparent, with spreads as the main cost, and tighter spreads reduce expenses while reflecting real market conditions like liquidity and volatility.

However, they also have drawbacks, as spreads can widen in low liquidity or volatile markets, raising the break-even point, especially for smaller accounts, and in some cases, traders may face both spreads and commissions.

Spreads are the difference between the bid and ask price, and in CFD trading, they represent the main cost for traders. They are influenced by liquidity, volatility, trading hours, and broker models. Tight spreads can help reduce trading costs, which is an important consideration for many traders when evaluating overall trading conditions.

Ready to trade your edge?

Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies!

This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. It has been prepared without taking your objectives, financial situation and needs into account. Any references to past performance and forecasts are not reliable indicators of future results. Axi makes no representation and assumes no liability with regard to the accuracy and completeness of the content in this publication. Readers should seek their own advice.

FAQ

A narrow difference between bid and ask prices, usually seen in highly liquid markets, such as EUR/USD.

Low liquidity (after-hours, holidays) or high volatility (during news events) causes spreads to widen.

Major forex pairs and liquid indices typically have the tightest spreads.

They can’t control market-driven spreads, but they influence the effective spreads clients see through liquidity providers, technology, and pricing policies.

While the primary focus in CFDs is the bid-ask spread (the transaction cost), "spread trading" can also refer to a strategy where traders simultaneously take opposite positions (e.g., long and short) on two related financial instruments, such as two different futures contracts.