Since Ethereum’s launch in 2015 as a decentralised, open-source smart contract platform, its native currency, Ether (ETH), has experienced both rapid growth and sharp corrections. While volatility is typical in the cryptocurrency market, technical advancements within the Ethereum ecosystem and broader factors also influence investor sentiment.

Forecasting asset prices is speculative, and all prediction models have limitations, especially in the case of crypto. To add to this challenge, digital assets have existed for just over a decade and lack the long-term historical data that supports predictions for traditional assets like gold or silver.

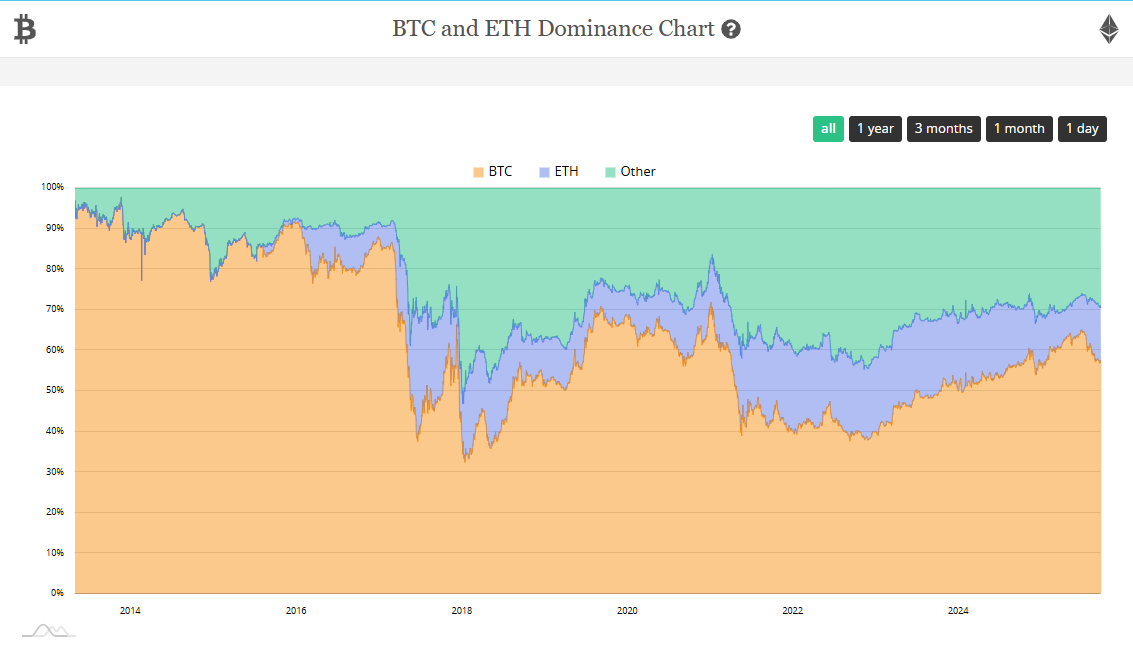

Ether (ETH) is the native cryptocurrency of Ethereum, the second-largest blockchain network by market capitalisation, behind Bitcoin.

ETH functions as a digital currency, an investment asset, and a utility token used to pay for transaction fees and computational services on the network.

Ethereum was proposed by Vitalik Buterin in 2013 to expand on Bitcoin’s capabilities by supporting programmable smart contracts. This innovation laid the groundwork for entire ecosystems, including decentralised finance (DeFi), non-fungible tokens (NFTs), decentralised autonomous organisations (DAOs), and the broader Web3 movement.

The Ethereum blockchain enables transparent and permanent transactions, making it ideal for executing smart contracts and powering decentralised applications (dApps). These smart contracts facilitate peer-to-peer financial services, allowing users to lend, borrow, invest, and generate yield without traditional intermediaries. Early use cases included raising funds through token sales based on the Ethereum ERC-20 standard.

Ethereum’s popularity has led to high network congestion and soaring gas fees, especially during bull markets. These issues sparked competition from other smart contract platforms like Cardano and Solana, which promised faster and cheaper transactions.

To address scalability and sustainability concerns, Ethereum performed an important update called "The Merge" in September 2022. Through the update, Ethereum transitioned from a Proof-of-Work (PoW) model (like the one used by Bitcoin) to a Proof-of-Stake (PoS) consensus mechanism.

The transition to Proof-of-Stake (PoS) dramatically reduced Ethereum's energy consumption by roughly 99.9% compared to the former Proof-of-Work (PoW) system by selecting validators based on staked ETH instead of mining hardware, lowering the entry barrier (requiring only 32 ETH) but also improving scalability.

However, this system introduces centralisation concerns, as the substantial capital required for staking concentrates influence among large ETH holders.

Ethereum's main challenges remain scalability, network congestion, smart contract security, and improving the overall user experience.

To overcome these, the community is actively developing Layer 2 scaling solutions, implementing security upgrades, enhancing cross-chain bridges, and advancing decentralised governance. These ongoing efforts are critical for Ethereum's long-term success and will likely influence the future demand and price of ETH.

Analysing the price of ETH involves a mix of fundamental, technical, and on-chain analysis, as well as insights into the token's supply mechanics.

Technical analysis involves studying historical market data, primarily price and volume, to forecast future movements. It uses indicators and chart patterns to identify trends and trading opportunities. Common tools include:

These indicators help investors and traders identify market sentiment, trend reversals, and entry/exit points.

On-chain metrics provide blockchain-native data that reflects network activity and investor behaviour. Tools like Glassnode, The Block, and MLQ offer access to key metrics such as:

These metrics complement technical analysis and can highlight trends not immediately visible on price charts.

“Tokenomics” refers to the economic design and supply characteristics of tokens (like ETH). Key factors include:

Issuance Rate and Burn Mechanism: Since "The Merge" and the transition to PoS, the issuance of new ETH has dropped dramatically. At the same time, the EIP-1559 upgrade continues to "burn" (destroy) a portion of transaction fees. As a result, ETH supply can become deflationary during periods of high network activity, as more ETH is burned than is issued.

Circulating vs. Total Supply: Unlike Bitcoin, Ethereum does not have a fixed supply cap. The more relevant metric is the circulating supply, currently around 120 million, which has been slightly deflationary since The Merge. Staking locks a large share of ETH, thereby reducing its tradable supply.

Sites like www.coinmarketcap.com, www.coingecko.com, and www.messari.com offer live data on supply metrics, issuance schedules, and valuation benchmarks.

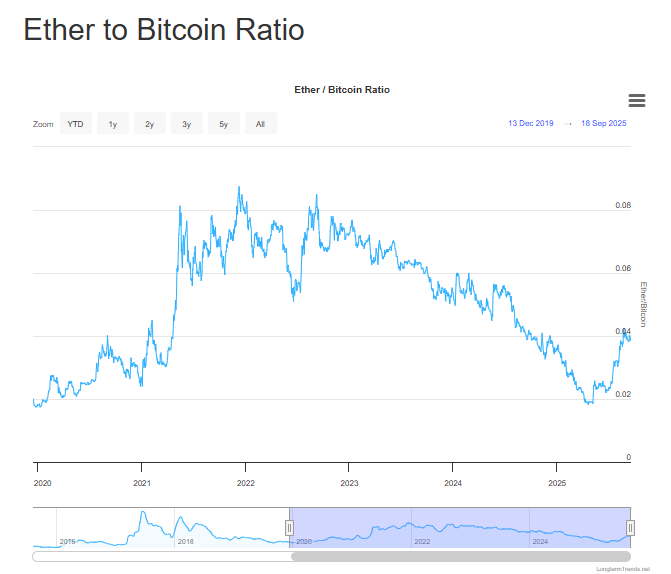

The ratio in the chart above divides the price of Ether by the price of Bitcoin and represents the amount of Bitcoin it takes to buy 1 Ether.

Ethereum (ETH) has historically moved in close correlation with Bitcoin (BTC), the world’s largest cryptocurrency. However, this relationship has been shifting.

While Bitcoin is primarily viewed as a secure, decentralised “digital gold,” Ethereum’s value is tied to its role as a settlement layer for decentralised applications, Layer 2 scaling solutions, and tokenisation. This growing utility has helped ETH develop a more independent price narrative.

As Ethereum adoption expands, from smart contract activity to institutional products like ETFs, its price is increasingly influenced by its own fundamentals. This makes ETH more appealing to investors who want to diversify their portfolios beyond Bitcoin’s store-of-value narrative.

The value of ETH is directly tied to its utility within the Ethereum network, where demand is driven by a rapidly growing ecosystem of decentralised finance (DeFi), NFTs, and Web3 applications. This demand has been greatly affected by the growth of Layer 2 (L2) scaling solutions, which handle most transactions, making the network faster and lowering mainnet transaction fees.

This scaling shift has enabled network activity to increase. There are now more than 680,000 active daily addresses, and a substantial portion of this activity takes place on L2 networks. While there is still competition from other Layer 1 platforms, Ethereum's dominant position is reinforced by its scalable and improving ecosystem.

ETH's price is highly responsive to sentiment. Endorsements by influential figures, developments in major DeFi protocols (e.g., MakerDAO, Aave, Uniswap), and enterprise blockchain initiatives can quickly shift demand. Similarly, statements from the Ethereum Foundation or Vitalik Buterin, often delivered via social media or interviews, can spark notable market reactions. Large ETH holders, or "whales", also play a role by executing high-volume transactions that can influence short-term price volatility.

The price of Ethereum (ETH) is very responsive to broader macroeconomic and regulatory changes, reflecting both institutional and retail interest in Ethereum.

A favourable regulatory environment in the United States, with increased clarity from the SEC regarding DeFi, staking, and ETF mechanisms, has played a significant role in generating confidence.

The broader macroeconomic landscape also influences ETH's appeal. A dovish stance by the Federal Reserve and the resulting low-yield environment for traditional assets make higher-yield opportunities, such as Ethereum's staking rewards, more attractive to investors.

Year |

Lowest Price (USD) |

Highest Price (USD) |

Average Price* (USD) |

|

2015 |

0.42 |

3.54 |

0.91 |

|

2016 |

0.93 |

21.52 |

9.55 |

|

2017 |

7.98 |

881.94 |

360.33 |

|

2018 |

82.83 |

1,432.88 |

514.25 |

|

2019 |

102.93 |

361.40 |

179.11 |

|

2020 |

95.18 |

621.17 |

238.93 |

|

2021 |

718.11 |

4,891.70 |

2,882.92 |

|

2022 |

896.11 |

3,876.79 |

2,238.68 |

|

2023 |

1,192.89 |

2,445.02 |

1,795.16 |

|

2024 |

2,112 |

4,095 |

3,042 |

|

2025 |

1,386 |

4,955 (to date) |

ongoing |

* Calculated by taking the sum of the daily closing prices and dividing it by the number of days in the year.

Since its launch in 2015 at a price around $0.74, Ethereum (ETH) has experienced significant price volatility. A key event in 2016 was the hack of the Decentralised Autonomous Organization (DAO), which led to a network split into Ethereum (ETH) and Ethereum Classic (ETC). That same year, the listing of ETH on Coinbase increased its market accessibility.

The price reached a peak above $1,400 in January 2018 before a prolonged correction. Following a drop below $100 during the 2020 market crash, the 2021 bull run saw ETH reach its all-time high, driven by the growth of decentralised finance (DeFi) and non-fungible tokens (NFTs).

More recently, ETH has traded near all-time highs in 2025, with prices peaking around $4,955. This price action has coincided with major protocol upgrades such as Shanghai (2023) and Pectra (2025), the most comprehensive upgrade since The Merge, which enhanced wallet functionality, increased the validator staking limit, and improved overall efficiency and user experience.

Ethereum's roadmap is a multi-phase development plan designed to improve the network's scalability, security, and decentralisation. The implementation of these upgrades is a continuous process guided by community consensus rather than a fixed schedule. The roadmap focuses on a parallel development approach, with several key goals pursued simultaneously.

The Surge phase aims to achieve massive scaling by developing data sharding, which divides the blockchain into smaller, more manageable pieces. The Dencun upgrade was a significant step toward this goal.

The Scourge and The Verge: These two phases address censorship resistance and decentralisation within the proof-of-stake system. Efforts focus on reducing centralisation among validators and making it easier for everyday users to run nodes, ensuring the network remains accessible to all.

The Purge and The Splurge: These phases prioritise the network's long-term efficiency and sustainability. The Purge strives to decrease the volume of historical data that nodes need to store, thereby streamlining node operations and reducing hardware needs. “The Splurge” is a general term for various ongoing improvements, including user experience enhancements and bug fixes.

Pectra (2025): The most comprehensive upgrade since The Merge, combining the Prague execution layer and Electra consensus layer updates. It implemented 11 Ethereum Improvement Proposals (EIPs), enhanced wallet functionality, increased the validator staking limit, and improved overall network efficiency and user experience.

ETFs provide an accessible, regulated way for investors to gain exposure to cryptocurrencies. The approval of spot Bitcoin ETFs in January 2024 paved the way for similar products. Following this, investor interest extended to Ethereum, leading the SEC to approve nine spot Ether ETFs on July 23, 2024. BlackRock’s iShares Ethereum Trust (ETHA), approved on July 23, 2024, and launched shortly after, has since become a significant fund, managing over $17 billion in assets by mid-September 2025.

The regulatory conversation has now shifted toward staking. BlackRock and other issuers have filed amendments to enable staking within their ETFs, aiming to generate additional yield for investors. The SEC has delayed decisions on these proposals, with new deadlines set for late 2025. This cautious approach reflects ongoing regulatory evaluation of staking's implications.

The SEC has also streamlined ETF operations by approving in-kind creation and redemption mechanisms for crypto ETPs. This change improves efficiency and better aligns these products with traditional ETF standards. The successful launch and adoption of both spot Bitcoin and Ether ETFs reflect a maturing market and an evolving, increasingly supportive regulatory environment.

Tokenisation, the process of bringing real-world assets (RWAs) like U.S. Treasury bonds and private credit on-chain, is quickly changing the financial world. Ethereum's long-term utility sees tokenisation as a key driver, enhancing the liquidity, transparency, and accessibility of assets.

Major financial players are now embracing this technology. As of mid-2025, firms like BlackRock, Franklin Templeton, JPMorgan, and Fidelity have launched large-scale tokenised products on Ethereum. BlackRock’s BUIDL fund now holds nearly $3 billion, while JPMorgan has issued $100 million in tokenised debt. The market for these tokenised assets on public blockchains has soared past $18 billion, with some projections suggesting the sector could reach a multi-trillion-dollar valuation by 2030.

Ethereum's infrastructure, mature standards, and thriving DeFi ecosystem make it the platform of choice for these initiatives. By integrating tokenised RWAs into DeFi protocols, these assets can be used as collateral and complement the network's growing stablecoin ecosystem. This integration solidifies Ethereum’s role as a core settlement layer for the future of digital finance.

While market cycles and crypto speculation can influence interest, the long-term growth trajectory is clear. The ongoing institutional engagement and increasing regulatory clarity are strong indicators that tokenisation is here to stay.

Please be aware that the prices and forecasts displayed in this table and the sections that follow are all derived from third-party data and are curated to provide an overview of current market sentiment.

Source/ Year |

2025 (end of year) |

2026 |

2030 |

2040 |

2050 |

|

Cathie Wood, (Ark Invest) |

8,000 |

* |

166,000 |

* |

* |

|

Changelly |

5,907-7194 |

8,232-10284 |

38,664-46,066 |

168,296-193,278 |

226,147-259,018 |

|

Coincodex |

8,139-8,745 |

5,037-7,899 |

12,260-13,188 |

19,046-21,046 |

30,815-33,148 |

|

Coinpedia |

2,917-6,925 |

5,566-6,610 |

12,647-15,575 |

117,684-255,282 |

117,684-255,282 |

|

Digitalcoinprice |

4,074-10,016 |

9,873-11,851 |

21,820-25,066 |

* |

* |

|

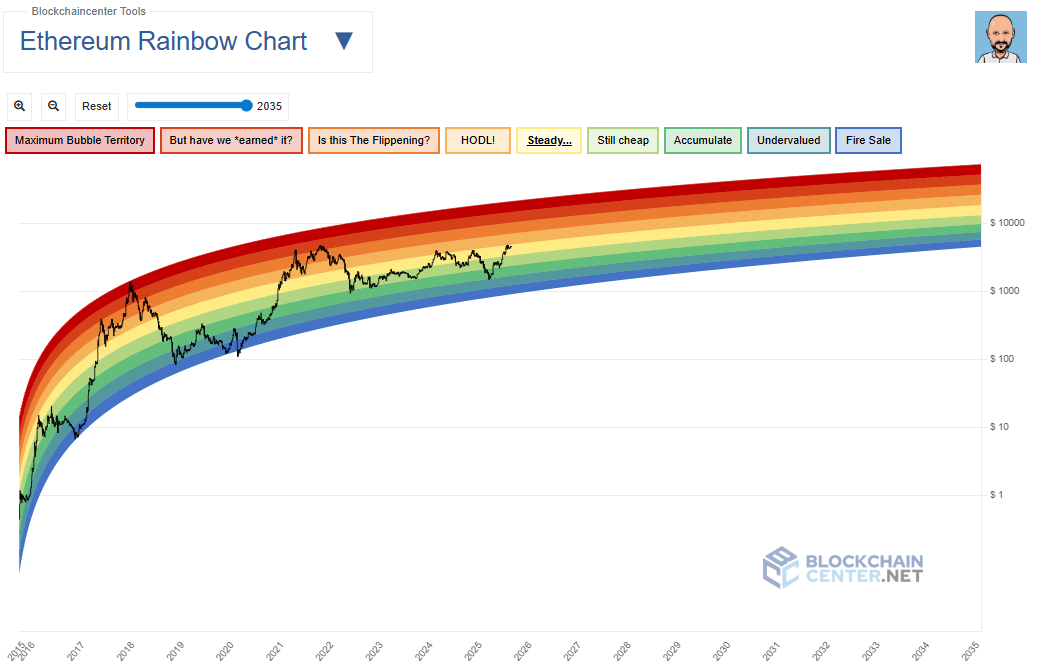

Ethereum Rainbow Chart |

934-22,109 |

975-26,324 |

2,158-44,916 |

* |

* |

|

Galaxy Research |

5,500 |

* |

* |

* |

* |

|

Ovenadd.com |

4,610-5,883 |

7,473-9,062 |

19,397-21,146 |

75,838-79,527 |

155,175-166,940 |

|

Standard Chartered |

7,500 |

* |

2028: 25,000 |

* |

* |

|

Tom Lee BitMine) |

7,000-16,000 |

* |

* |

62,000 |

* |

|

Van Eck |

6,000 |

* |

11,800 |

* |

* |

* Price prediction not provided from this source for this year

Ethereum’s success in 2025 relies on three key factors: ETF inflows, retail interest, and network growth. These drivers can shape demand and provide the momentum for significant price movements.

Fundstrat’s Tom Lee has emphasised Ethereum’s unique role in the broader crypto landscape, likening it to the wave of financial innovation on Wall Street after the US left the gold standard in 1971. He sees Ethereum not just as liquidity-sensitive like Bitcoin, but as a key platform for blockchain-based AI integration and stablecoin adoption.

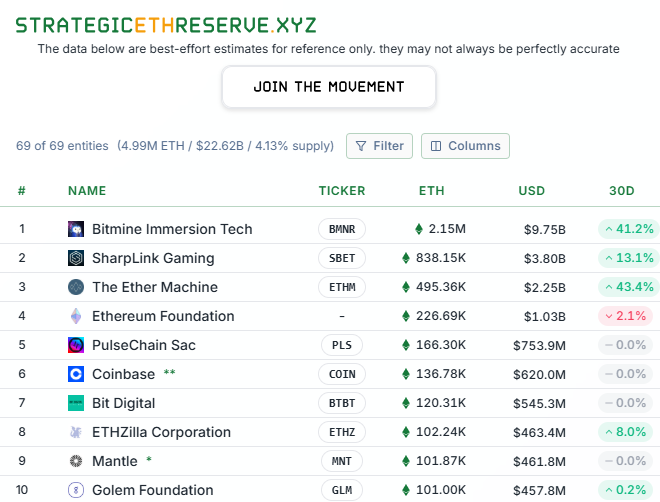

Institutional interest and the growing roles of treasuries shape the narrative around ETH accumulation. BitMine alone has revealed substantial Ether holdings worth close to $10 billion (around 1.8% of the total supply).

Galaxy Research’s Alex Thorn projects Ethereum could hit $5,500 in 2025, supported by the possibility of a pro-crypto administration in the United States. Meanwhile, VanEck expects a move to $6,000 this year, driven by staking-enabled funds and expanding network revenues.

Ark Invest’s Cathie Wood gives a bolder outlook, suggesting ETH could surpass a $1 trillion market cap, valuing the asset at over $8,000. Standard Chartered is similarly bullish, forecasting a price of $7,500 by year-end, attributing growth to institutional adoption and treasury buying.

Retail-focused forecasts echo these forecasts. Analysts at Ovenadd.com expect ETH to reach a maximum of $5,883, citing growing demand for decentralised applications. Changelly sets a broad range of $5,907-$7,194.

In summary, while predictions vary, the consensus for 2025 points to Ethereum breaking above $6,000, supported by ETFs, institutional flows, and network growth.

By 2026, Ethereum’s outlook is increasingly tied to mainstream blockchain adoption and industry integration. With continuous development and innovation, analysts expect ETH to maintain steady growth.

Ovenadd highlights Ethereum’s expanding role in powering decentralised applications and expects further appreciation as businesses increasingly rely on blockchains. Their analysis suggests Ethereum could achieve new highs on the back of network maturity and real-world integration.

Changelly’s 2026 forecast anticipates a trading range of $8,232-$10,284, reinforcing the expectation of sustainable, incremental growth.

The Ethereum Rainbow Chart, a logarithmic valuation model indicating market sentiments, can help investors gauge potential investment moments by aligning price movements with various sentiment-driven colour bands. For 2026, it suggests a wide possible range of $764-$22,164.

While less aggressive than 2025, the projections for 2026 point toward a consolidation phase, with Ethereum stabilising in the $8,000-$10,000 range as adoption deepens.

Long-term ETH bulls predict historic prices by 2030, citing the asset's central position in DeFi, real-world asset tokenisation, and Web3 infrastructure.

Cathie Wood (Ark Invest) has one of the most ambitious outlooks, estimating Ethereum’s market cap could reach $20 trillion, translating into a token value of around $166,000.

Standard Chartered anticipates a price of $25,000 by 2028, reflecting confidence in Ethereum’s traction within the DeFi space and positioning ETH for a strong bull run into 2030.

VanEck’s Matthew Sigel and Patrick Bush forecast ETH at $11,800 by 2030, basing their valuation on rising network revenues and cash flow, from $2.6 billion today to a projected $51 billion.

Changelly provides a more moderate forecast, with a price range of $38,664-$46,066, still showing significant growth compared to 2025 and 2026 estimates.

Ovenadd also remains optimistic, pointing to the value of Ethereum’s continued improvements and network resilience.

Overall, 2030 marks a pivotal year in most forecasts, with expectations ranging from five-digit valuations to six-figure “moonshot” scenarios.

Looking toward 2040, Ethereum’s trajectory becomes even more speculative, based on decades of technological, regulatory, and macroeconomic developments.

Tom Lee’s outlook suggests ETH could reach $62,000 if Bitcoin achieves his long-term price target of $250,000. This view reflects Ethereum’s close correlation with broader crypto cycles as well as its distinct growth factors.

Ovenadd envisions a much larger price range, with Ethereum potentially climbing as high as $79,527. Their analysis emphasises regulatory evolution and widespread blockchain acceptance as the key catalysts for sustained growth.

Changelly presents an even more dramatic forecast, estimating a range of $168,296–$193,278 for 2040, underscoring expectations of exponential adoption.

These projections, though wide-ranging, point to Ethereum’s continued relevance in a digital-first global economy.

Forecasting Ethereum's price by 2050 is more of a thought experiment than a precise analysis, as the global economy, regulatory frameworks, and technological landscape will likely be unrecognisable compared to today.

Coincodex projects ETH between $30,815 and $33,148 by 2050, while OvenAdd envisions prices reaching nearly $89,316.15, emphasising Ethereum’s growth potential but also the uncertainties inherent in such a long time frame.

Changelly’s 2050 forecast suggests a price range of $226,147-$259,018, a valuation that would firmly establish Ethereum as a cornerstone of the future global financial system.

As the cryptocurrency market enters a new phase, Ethereum is increasingly serving as the default settlement and issuance layer for tokenised assets, including stablecoins, digital treasuries, and DeFi protocols. This has resulted in a network effect and long-term stickiness among developers and institutions. With the stablecoin market projected to grow from $280 billion to over $4 trillion, and with many of these assets issued on Ethereum, the network is well positioned to capture a significant share. Ethereum's smart contract capabilities also give the structural flexibility required to enable sophisticated financial processes, confirming its position as a new basis for modern finance. Forecasts from 2025 to 2050 are necessarily hypothetical, but the underlying trend is clear: if blockchain continues to integrate into global banking, government, and AI-driven systems, Ethereum has the potential to become one of the world's most valuable assets.

Ready to trade your edge?

Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies!

References to forecasts and past performance are not reliable indicators of future results.

The images shown are for illustration purposes only. Data is sourced from third party providers.

This information is for educational purposes only and is not intended to be financial product advice or any investment recommendation. It is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. It has been prepared without taking your objectives, financial situation and needs into account. Axi makes no representation and assumes no liability with regard to the accuracy and completeness of the content in this publication. Readers should seek their own advice.